Personal Exemption Allocation Election - This means that we dont yet have the updated form for the current tax year. Affirmatively electing to allocate the exemption by reporting it on Form 709 Schedule C Part 2 line 6 and attaching a Notice of Allocation provides a clear record of the taxpayers intent to have GST tax exemption allocated to the trust and exactly how much exemption has been allocated.

Federal Register Limitation On Deduction For Business Interest Expense Allocation Of Interest Expense By Passthrough Entities Dividends Paid By Regulated Investment Companies Application Of Limitation On Deduction For Business Interest Expense

Please check this page regularly as we will post the updated form as soon as it is released by the Arizona Department of Revenue.

Personal exemption allocation election. 20 rows Personal Exemption Allocation Election. Limitation on Eligibility for the Exemption. 2632c3B as a trust that could have a GST with respect to the transferor unless certain provisions within the trust instrument disqualify it as a GST.

Under United States tax law a personal exemption is an amount that a resident taxpayer is entitled to claim as a tax deduction against personal income in calculating taxable income and consequently federal income tax. However Attorney failed to attach a. If exemption is allocated to this trust and there ends up not being a skip youve effectively wasted your exemption.

In the second blank box enter the Social Security number of the spouse claiming more than one half of the total exemption. The personal representative in a PLR requested an extension of time to allocate the GSTT exemption to the trust. A GST trust is defined under Sec.

3019100-3b1v met the requirements of acting reasonably and in good faith. Once you make this election for the tax year you cannot change the agreed upon amounts for that year without making another election. A married person who qualifies to file as head of household with one spouse claiming a personal exemption of more than 3150 of the 6300 exemption.

In a series of recent private letter rulings the IRS addressed the circumstances under which taxpayers or their personal representatives may obtain relief to file late elections in or out of the allocation of the generation-skipping transfer GST tax exemption in regard to transfers to GST trusts. Arizona Personal Exemption Allocation Election 202 Step 3. The GST tax exemption is allocated on an item by item basis on Form 709 Part 3 Tax Computation column C.

Arizona Personal Exemption Allocation Election 202 Step 4. Net TE interest 4167 Add. When you file a joint return you and your spouse will each receive the 4000 personal exemption plus the married filing jointly standard deduction of 12600 add 1250 for each spouse over the age of 65.

In the third blank box enter the name of the spouse claiming less than one half of the total exemption. So what could easily happen is that a trust is defined as a GST Trust so exemption gets automatically allocated to it even though the chances of a skip were remote and a skip never happens. Note that there are a few potential elections.

We last updated the Personal Exemption Allocation Election in May 2021 and the latest form we have available is for tax year 2018. Locally Assessed Property - Application Required. Arizona Personal Exemption Allocation Election 202 Step 5.

In 2017 the personal exemption amount was 4050 though the exemption is subject to phase-out limitations. Prior-year transfers that are subject to section 2642f and to which the election out is to apply must be specifically described or otherwise identified in the election. The election out statement must identify the trust except for an election out under paragraph b2iiiA4 of this section and specifically must provide that the transferor is electing out of the automatic allocation of GST exemption with respect to the described transfer or transfers.

The most secure digital platform to get legally binding electronically signed documents in just a few seconds. The taxpayer must file one 1 or more of the lists of taxable personal property as required by Section 63-302 Section 63-313 or Section 63. Except for taxpayers claiming and receiving the exemption provided for in Section 63-4502 Idaho Code taxpayers receiving the personal property exemption provided in Section 63-602KK Idaho Code may be eligible for and are not precluded from other applicable exemptions.

The Tax Cuts and Jobs Act of 2017 eliminates personal. Complete Part 3 or Part 4. In addition the personal representatives of Taxpayers estate request a ruling that with respect to Taxpayers.

Married Filing Jointly is usually better even if one spouse had little or no income. Start a free trial now to save yourself time and money. Section 350103626 - PROPERTY EXEMPT FROM TAXATION - CERTAIN PERSONAL PROPERTY.

The personal representatives of Taxpayers estate request an extension of time under 2642g and 3019100-3 to elect out of the automatic allocation of Taxpayers GST exemption to the transfers to GRATs 1 through 12. You are eligible for more credits including education. 1 420000 420000 2 Amount of personal exemption each spouse is claiming prior to.

Sections 63-105A 63-201 63-302 63-308 63-313 63-602Y 63-602KK Idaho Code. Exemptions reduce your taxable income. Form used by married taxpayers filing separate returns or heads of household who are claiming an amount other than 12 allowable personal exemption amount.

Complete Part III or Part IV Once you make this election for a tax year you cannot change the agreed upon amounts for that year without making another election. Husband elected out of the automatic allocation rules with respect tothe gift to Trust in Year. Download or print the 2020 Arizona Personal Exemption Allocation Election 2020 and other income tax forms from the Arizona Department of Revenue.

If GSTT exemption is not allocated to such a trust future distributions to the decedents grandchildren would be subject to GSTT. The personal exemption amount is adjusted each year for inflation. How you claim an exemption on your tax return depends on which form you file.

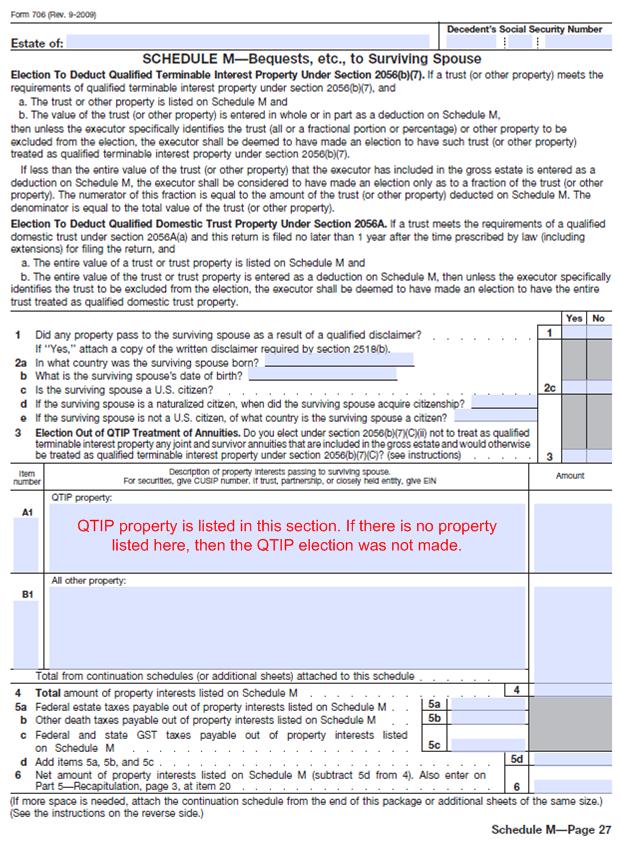

The trustees were directed to file a supplemental Form 706 on which they could sever the marital trust make the reverse QTIP election and allocate the decedents GST exemption to the exempt trust. Taxable income 50733 Less. Available for PC iOS and Android.

Fill out securely sign print or email your Printable 2020 Arizona Form 202 Personal Exemption Allocation Election instantly with signNow. Exemption 100 Taxable income 50733 DNI. A married person who qualifies to file as head of household with one spouse claiming a personal exemption of more than 3 150 of the 6300 exemption.

Attorney correctly reported the transfer to Trust as an indirect skip on Schedule A Part 3. You can deduct 4050 for each exemption you claim in 2016. The personal exemption is an automatic deduction provided for by the IRS.

1 Total personal exemption allowed prior to prorating married taxpayers claiming no dependents. Exemption 100 DNI 25000 Allocation of expenses to TE interest. For purposes of this provision a GST Trust is defined quite broadly.

Attorney also allocated GST exemption to the transfer on Schedule D Part 2 Line 6. Section 262632-1b2iii provides that a transferor may prevent the automatic allocation of GST tax exemption to any transfer constituting an indirect skip by attaching a statement election. One-half by each spouse under 2513.

An election for branch exemption should be made to the companys Customer Compliance Manager CCM or in the absence of a CCM to the office where the companys tax return is dealt with. As in the other letter rulings the trustees reasonable reliance on a qualified tax professional under Regs.

Gt S Quick Guide To Section 338 H 10 Elections Insights Greenberg Traurig Llp

The Teenaged Tax Comes Of Age Fran M

3 11 14 Income Tax Returns For Estates And Trusts Forms 1041 1041 Qft And 1041 N Internal Revenue Service

Federal Register Limitation On Deduction For Business Interest Expense Allocation Of Interest Expense By Passthrough Entities Dividends Paid By Regulated Investment Companies Application Of Limitation On Deduction For Business Interest Expense

The Generation Skipping Transfer Tax A Quick Guide

2

Elections Exempted Categories Poling Personal Poling Duties Exemption Rules Apteachers Website

2

Taxpayer S Gst Tax Exemption Automatically Allocated To Direct Skips Wealth Management

2

Doing Business In The United States Federal Tax Issues Pwc

The Generation Skipping Transfer Tax A Quick Guide

Grants Frequently Asked Questions Faqs U S Election Assistance Commission

Qualified Terminal Interest Property Qtip Trusts